Introduction

In today’s rapidly changing business environment, financial sustainability is no longer just a buzzword—it’s a critical component of long-term success. At the heart of this transformation is SAP, a global leader in enterprise software solutions. SAP empowers businesses to manage their financial resources more effectively, ensuring they not only survive but thrive in a competitive landscape. By integrating robust financial management tools with sustainability initiatives, SAP helps companies achieve a delicate balance between profitability and long-term value creation.

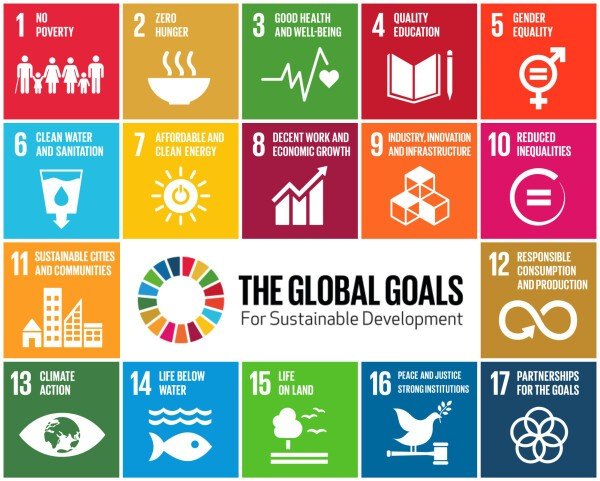

Financial sustainability is essential for modern businesses as it enables them to navigate economic uncertainties, meet regulatory demands, and maintain stakeholder confidence. Companies that prioritize sustainable financial practices are better positioned to innovate, grow, and contribute to broader societal goals, such as the UN Sustainable Development Goals (SDGs).

In this newsletter, we address some of the most frequently asked questions about financial sustainability. Whether you’re new to the concept or looking to deepen your understanding, this FAQ will provide valuable insights into how SAP can help your business achieve financial sustainability.

FAQ

1) What is financial sustainability?

Financial sustainability refers to a business’s ability to manage its financial resources to ensure long-term viability and success. This includes balancing short-term profitability with the need to maintain a stable financial foundation over time. Financial sustainability also encompasses integrating Environmental, Social, and Governance (ESG) factors into financial decision-making, ensuring that the company’s operations align with broader societal goals and ethical standards.

2) Why is financial sustainability becoming more important for businesses?

Financial sustainability is increasingly critical due to growing expectations from investors, consumers, and regulators for companies to operate responsibly and transparently. Incorporating ESG factors into financial strategies helps businesses manage risks, capitalize on opportunities, and meet regulatory requirements. Furthermore, aligning financial practices with the UN Sustainable Development Goals (SDGs) allows companies to contribute to global efforts in addressing challenges such as climate change, inequality, and sustainable economic growth.

3) How can technology support financial sustainability?

Technology, particularly advanced software solutions like SAP, supports financial sustainability by enabling businesses to integrate ESG data into their financial management processes. These tools provide real-time insights, automate reporting, and track progress against financial and sustainability targets. For example, SAP’s solutions can help companies measure their carbon footprint, monitor supply chain sustainability, and ensure compliance with ESG-related regulations, all of which contribute to achieving both financial and sustainability goals.

4) What is SAP, and how does it relate to financial sustainability?

Since SAP is a global leader in enterprise software, it helps businesses manage their operations, including finance, supply chain, and human resources. SAP plays a crucial role in financial sustainability by providing tools that integrate financial management with ESG considerations. Through platforms like SAP S/4HANA, companies can align their financial strategies with sustainability goals, ensuring that their operations contribute to both profitability and broader societal objectives, such as those outlined in the SDGs.

5) What are the key benefits of using SAP for financial management?

Using SAP for financial management offers several key benefits:

- Real-time insights

- Improved efficiency

- Enhanced transparency

- Scalability

6) How can businesses start their journey toward financial sustainability?

SAP enables financial sustainability by helping businesses manage resources effectively while integrating ESG factors into their strategies. This approach aligns with global goals like the UN SDGs, ensuring companies balance profitability with long-term stability and social responsibility. SAP’s tools provide real-time insights, automate processes, and enhance transparency, supporting responsible and sustainable business practices.

7) What industries benefit the most from SAP’s financial sustainability solutions?

SAP’s financial sustainability solutions are beneficial across various industries, but sectors such as manufacturing, retail, financial services, and healthcare often see significant advantages. These industries face complex challenges related to supply chain management, regulatory compliance, and ESG reporting—all areas where SAP’s tools can provide substantial value by integrating financial and sustainability data for better decision-making.

8) How does financial sustainability impact a company’s overall success?

Financial sustainability, particularly when integrated with ESG considerations, is crucial for long-term business success. Companies that manage their finances sustainably, while also addressing environmental and social responsibilities, are better equipped to navigate economic downturns, innovate, and build lasting relationships with stakeholders. By aligning their operations with the SDGs, financially sustainable businesses can also contribute to global goals, enhancing their reputation and attractiveness to investors who prioritize ESG factors.

9) How does SAP align with global sustainability initiatives like the UN Sustainable Development Goals (SDGs)?

By using SAP’s solutions, companies can track their progress towards these goals, report on their contributions to the SDGs, and make informed decisions that support both financial sustainability and broader societal impact.

10) What are the risks of ignoring financial sustainability?

Ignoring financial sustainability can lead to several risks for businesses, including financial instability, increased operational costs, and reduced investor confidence. Companies may struggle to adapt to economic changes, face regulatory penalties, and damage their reputation if they fail to address Environmental, Social, and Governance (ESG) issues. Over time, this can result in decreased competitiveness, loss of market share, and potential business failure. Additionally, neglecting financial sustainability may limit access to capital, as investors increasingly prioritize companies with strong sustainability practices.

Conclusion

Financial sustainability is vital for long-term business success, ensuring stability, growth, and the ability to meet evolving market demands. By integrating robust financial management with ESG considerations, companies can secure their future while contributing to broader societal goals. SAP is committed to supporting businesses on this journey, providing the tools and insights needed to achieve financial sustainability. Thank you for reading this edition of our newsletter. Stay tuned for the next issue, where we will delve deeper into practical strategies and case studies on how SAP can further enhance your business’s financial sustainability.