In our previous newsletter, we explored SAP Group Reporting’s Special Version feature, which offers dynamic flexibility in managing consolidation versions. By providing pre-defined versions and customizable settings, organizations can tailor their reporting to specific needs, enhancing adaptability and accuracy. This time, we’ll explore the Version concept further through a complex business case, modeling an example configuration to showcase its adaptability and accuracy in financial analysis.

Business Case

In our case, we’re considering a group company with over 100 subsidiaries operating worldwide. The holding company (CU001) of the group is located in Birmingham, UK, and its local currency is GBP. The holding company CU001 has various subsidiaries within the UK with different ownership rates, and it also has investments in numerous companies in Europe, South America, and Asia.

The group must consolidate all its companies in the UK for legal reporting, reporting in GBP as the group currency. Additionally, in Europe, a sub-consolidation is done for European companies, reporting in EUR as the group currency. In South America, a sub-group consolidation is done reporting in USD, and in Asia, it’s done reporting in JPY.

Additionally, the group wishes to conduct consolidations for the UK top consolidation using simulation rates and compare them with the results obtained using the original rates.

The described business case should be fully integrated into SAP Group Reporting, rather than applying the same processes separately to each group multiple times. This integration aims to reduce the need for extensive data reconciliation work.

Solution

In Group Reporting, a separate version is required for each currency that needs consolidation. This is because there are no settings for any currency on the Group main data or in the Group master definition. When defining the Group master, a version is selected, and the masters defined for the respective group. When the consolidation process is run for this version & group combination, the results are generated for the currency defined in the version. Therefore, currency management for the group is done at the version level.

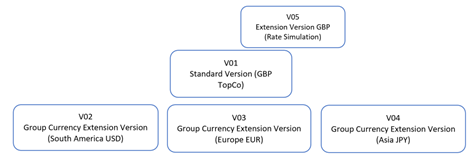

In our business case, we need one top group and three sub-groups as follows:

- Top Group: G0001

- Sub Group for South America: G0002

- Sub Group for Europe: G0003

- Sub Group for Asia: G0004

Due to the consolidation of the four groups in different currencies, a separate version will be needed for each group. Additionally, the UK Top Consolidation is desired to be conducted with simulation currency rates. Therefore, a version specifically for this purpose is also required.

The version structure will be set up as follows. Let’s now delve into the details of this structure.

In a consolidation process that involves the need for subgroups, the fundamental requirement of the Group Reporting team is to complete the consolidation within the subgroups and then combine these with the participation of the companies at the holding level to achieve top-level consolidation. To accomplish this, within the consolidation tool, for instance, when necessary group journals are posted within any subgroup, these entries should be automatically rolled over to the top group. Without this automation, numerous repetitive tasks would be required, leading to increased data reconciliation efforts. To avoid this, it’s crucial to design the implementation process correctly during the project phase.

In SAP Group Reporting, the group structure definition should be made flat. This means that all companies under a group should be added without intermediate subgroups. For subgroups, independent groups should be created, and the relevant companies should be linked flatly. In this case, the linkage between groups will be achieved through the version dimension.

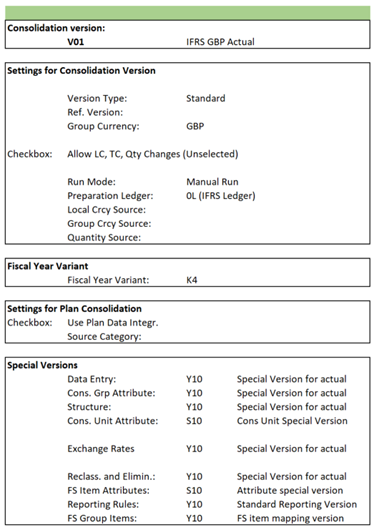

In our business case, for the top group G0001 UK, the V01 version was created with the following specifications: “Standard” type, group currency “GBP,” and run mode “Manual.” Thanks to these selections, V01 will act as the main version in the system, and all processes can be executed through the V01 selection.

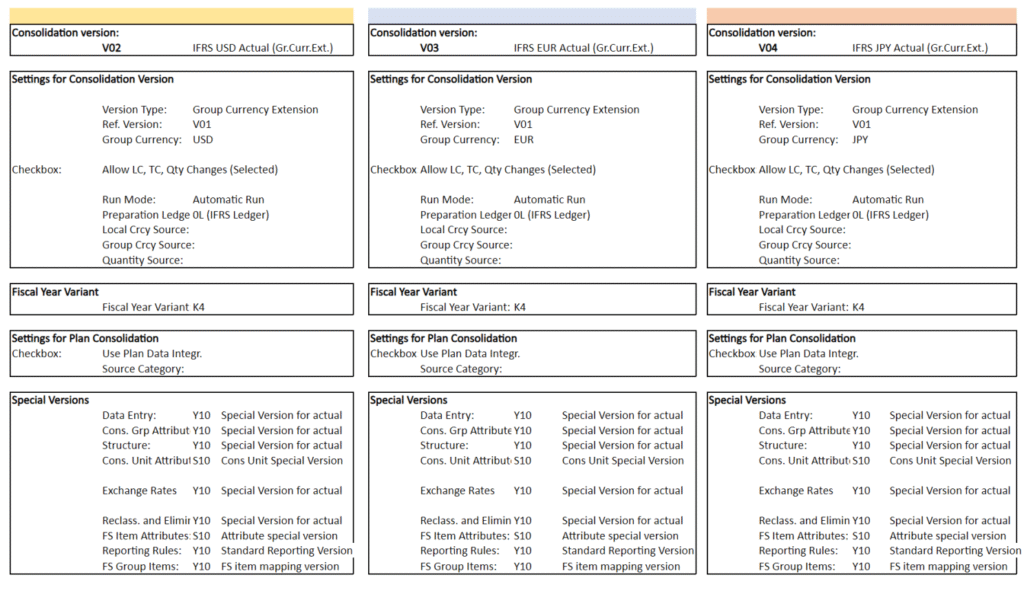

V02 was created for the G0002 South America subgroup in our business case. The key settings include version type “Group Currency Extension,” Reference Version “V01,” Group Currency “USD,” and Run Mode “Automatic Run.” Thanks to these selections, when processes run on V01, the necessary records for the G0002 group will be automatically created on the V02 version simultaneously.

Similarly, V03 and V04 were created with the following key settings and linked to V01 to complete the automatic consolidation structure.

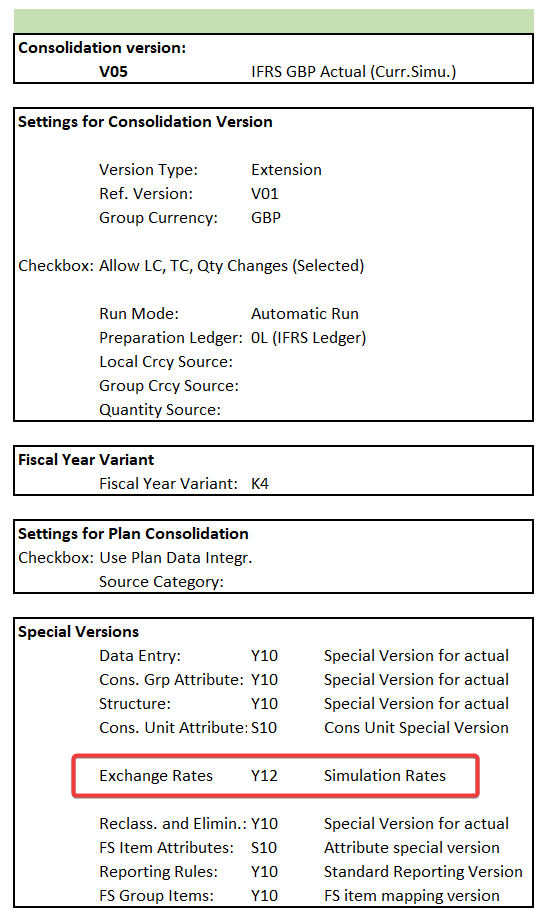

Lastly, in our business case, a second consolidation with simulation rates is required for the G0001 UK Top Group. For this purpose, the V05 version was created with the following key settings:

- Version type: Extension

- Group Currency: “GBP,” parallel to V01

- Reference Version: “V01”

- Run mode: “Automatic Run”

Additionally, in the Special Versions settings, the “Exchange Rates” version was changed to “Y12 Simulation Rates.” With these selections, when the consolidation process is run for V01, the system will generate results for the G0001 group with simulation rates on the V05 version, creating a separate dataset automatically.

Conclusion

In summary, SAP Group Reporting’s Special Version feature offers dynamic flexibility in managing consolidation versions. With pre-defined versions and customizable settings, organizations can tailor their reporting to specific needs, enhancing adaptability and accuracy. Our exploration delved into this concept through a complex business case, showcasing its precision and adaptability in financial analysis through example configurations. Specifically, we examined the use of key settings to manage versions for a large holding structure with subgroups in different group currencies.